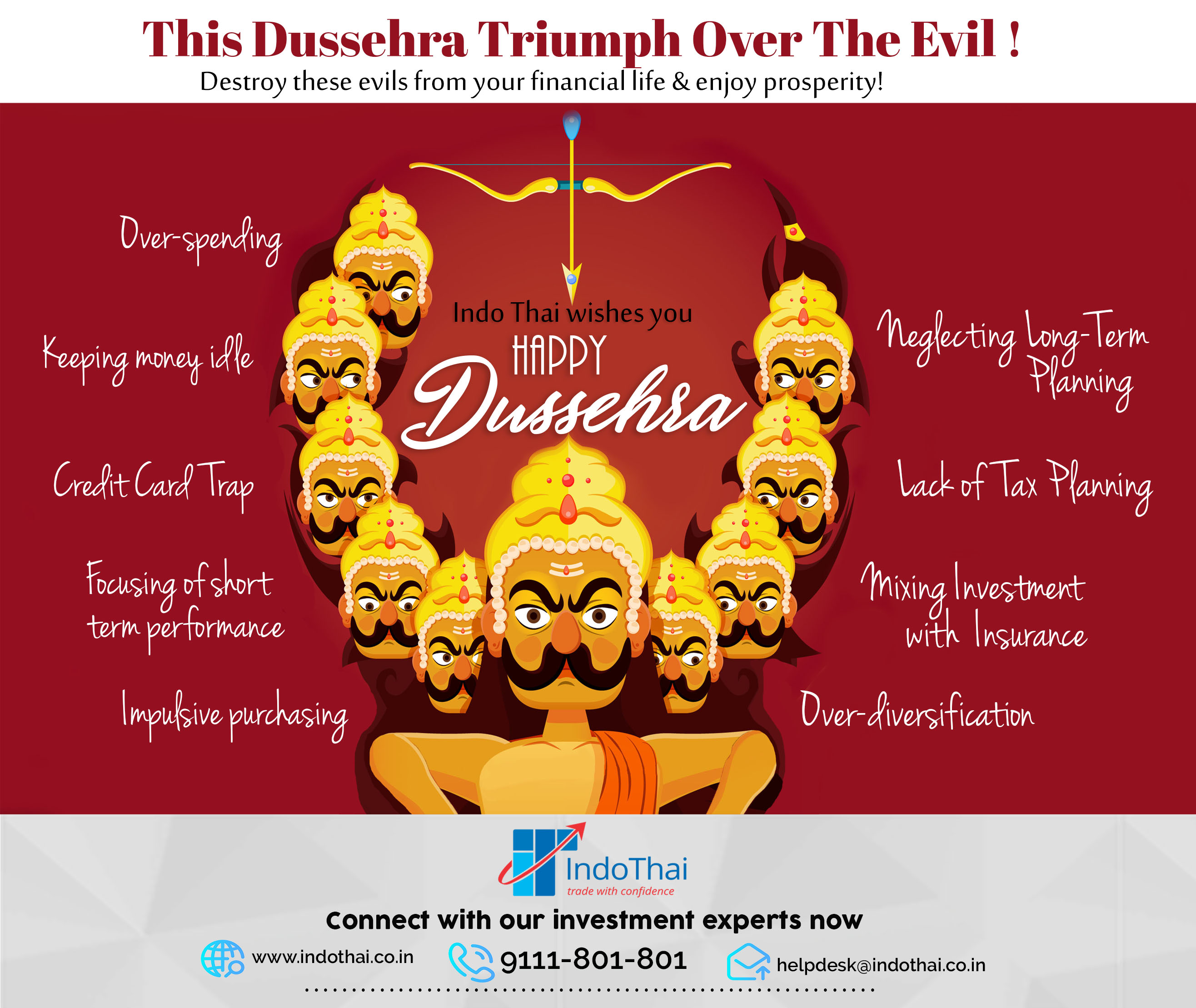

This Dussehra destroy the evils from your financial life & enjoy prosperity!

by : |in news| Mutual Funds Blog| 1 comments

The festival of Dussehra marks the victory of good over evil. The festival offers important lessons to eliminate all the stumbling stone for our financial planning and wealth creation journey.

Looking at the festival from a financial and investment perspective. There cannot be a better time to review your investment habits and eliminate the ‘evil’ from it.

Overspending

Spending more than you earn is the cardinal sin of personal finance. This one habit will have a trickle-down effect, causing big problems in all areas of your personal finances.

You can really do two things here. You can cut your spending and budget better, or you can focus on earning more money to close the gap.

Neglecting Long-Term Financial Planning

Many investors tend to zero in on a stock or mutual fund’s most recent performance, rather than looking at its financial historical track record to determine whether it’s a smart bet.

Investing is a long game and when the goal is building wealth, the number one trait investors need to have is patience.

Credit Card trap

“You will spend more money than you planned.” Yes, you will. Seems very easy to spend with a credit card without giving away the currency from the wallet.

Cut on the usage of credit card. It will help in maintaining your budget.

Focusing on Short-Term Financial Performance

Most individuals look at the most recent performance rather than looking at its historical track record which would lead a state of panic.

If investing for a long-term, do not focus on a short-term performance, rather look at the cumulative returns in long run.

Lack of Tax Planning

Most of us start investing in tax saving schemes at the end of the financial year when we get a reminder from our CA to submit investment proofs.

Invest in tax funds from the beginning to enjoy the full benefit of the fund as well as income tax benefits and cut on your last minute stress.

Over Diversification

Over-diversification is a serious and common mistake that decreases investment returns disproportionately to the benefits received. Over-diversification occurs when the number of investments in a portfolio exceeds the point where the marginal loss of expected return is greater than the marginal benefit of reduced risk.

The optimum portfolio diversification is to own a number of individual investments large enough to nearly eliminate unsystematic risk but small enough to concentrate on the best opportunities.

Mixing insurance with investment

Mixing insurance with investment is a common mistake with many investors’ portfolios. “They don’t plan for wealth protection; they think LIC (Life Insurance Corp. of India) is investments.

Investors must have a term plan, and just that for their life insurance needs & make a separate investment plan for wealth creation.

Keeping money Idle

Keeping your money idle is as good as losing it.

Make your money work for you by investing in the right instruments.

Impulse Purchasing

impulsive buying behavior leads to overspending and ultimately losing your wealth.

Focus on putting your money to work rather than impulsive buying.

Amidst this auspicious celebration, take your steps to the investment journey with small but regular investments. Accumulate a good sum over a period.

Investing efficiently plays a key role in building long-term wealth.

“We wish you a prosperous Dussehra!”